The Business Of

The NA Era: Why Restaurants Are Going Sober-Curious

Rapidly innovating and demanded by diners, non-alcoholic beverages are ready for their close-up.

What would happen to a restaurant if you took alcohol off the menu? Just snapped your fingers and eliminated the highest-margin item in the building.

For one thing, the restaurant would lose the source of about 80% of its gross profit. Its cost of goods would skyrocket. Tables might turn faster, but the cost of that turnover would be a product category that accounts for 20–25% of gross revenue. Losing alcohol would be very, very bad.

Luckily for restaurants, no one (that we know of) is plotting a comeback for the 18th amendment. But operators do need to keep an eye on a trend that started emerging before the pandemic and has only accelerated since: Young diners are drinking less alcohol than older diners. Lower alcohol consumption, in the long run, could lower check sizes and squeeze restaurant revenues.

Into the breach of this trend has emerged a new kind of product. Non-alcoholic (“NA”) or “zero-proof” beverages have exploded as a category in recent years, especially in the fine dining concepts and cocktail bars where low/no ABV beer has historically not penetrated.

You’ve probably seen the buzz; it’s been unmissable in restaurant media. But what’s really going on with NA beverages?

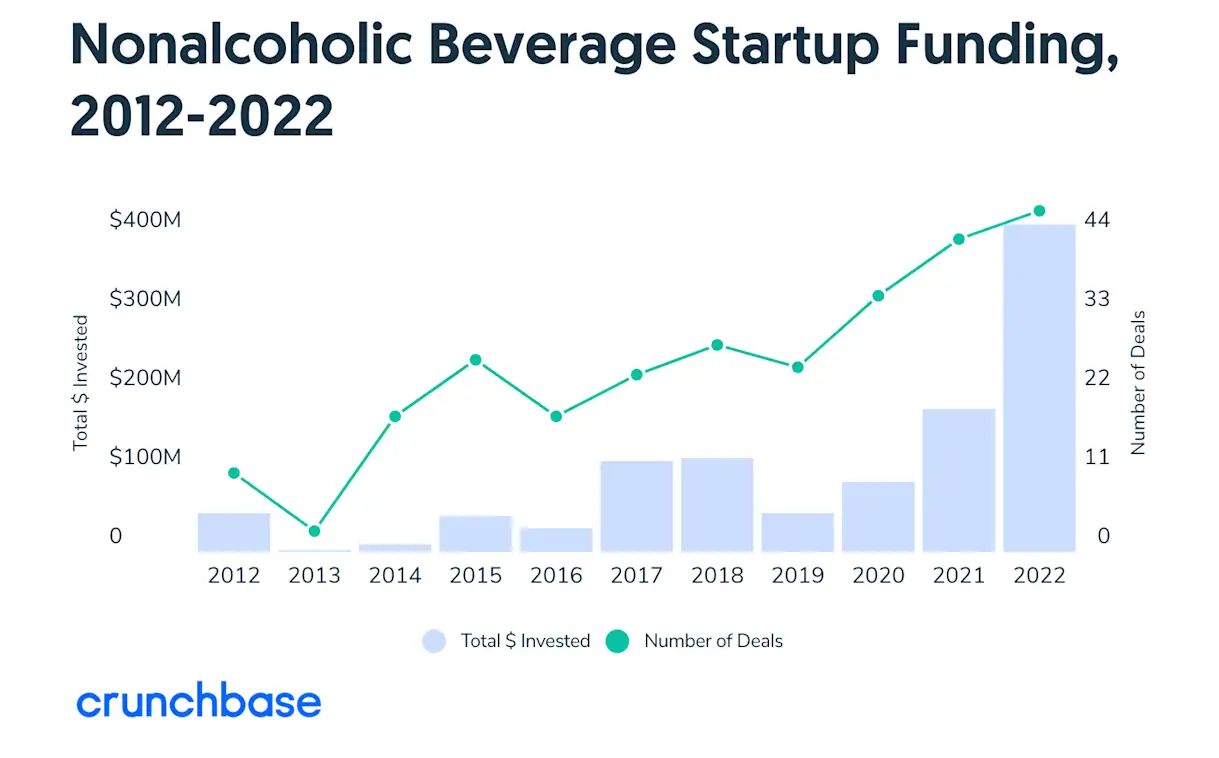

Source: Crunchbase

On an anecdotal level, many restaurant operators probably haven’t noticed a sharp change in alcohol orders. Alcohol continues to sell close to historic highs, even despite the post-pandemic drag of inflation. Meanwhile, NA beverage makers have seen an astounding 736% increase in venture capital over the past decade. Bold predictions about the projected growth of the non-alcoholic sector abound.

Are people actually ordering these drinks, or are we just hearing fluff put out by investors eager to spark the next big thing?

After talking to operators, vendors, and diners — both sober and not — it seems like today’s NA drinks do indeed reflect customer expectations that are changing, probably for the long term.

Restaurants would be wise to take notice.

Listening to demand

When data engineer Sam Bail lived in Manhattan’s Lower East Side, she loved her apartment. Which, in New York City parlance, meant that she loved her neighborhood.

Bail shared a two-bedroom unit with a roommate. “It was the tiniest apartment imaginable. We didn’t have a real kitchen, living room, anything.” Staying inside too long was never pleasant. So she went outside, to the bar down the street.

“I would head to RPM just to hang out and get out of the house. Basically, that was my living room.”

RPM, since renamed Emma Peel Room, didn’t have a sofa or dinner table, but it did host a crew of neighborhood regulars who, just like Sam, gathered just to hang out. They were her friends. The scene, in her mind, was a social place first and foremost, not a drinking place.

Before long, Sam grew tired of feeling pressured to drink alcohol so often. She made a decision that, by all indications, is growing more common among younger diners.

She stopped drinking alcohol completely.

Sam Bail enjoying a mocktail at NYC’s Gage & Tollner. (Via Instagram)

Giving up alcohol was a revelation. She started questioning why drinking played such a central role in the way we interact socially. Having grown up in Germany and the UK, Bail understood cultures that celebrated alcohol. Inebriation, she felt, was rarely the goal of drinking.

“I believe many people go drinking mostly for social connection. Oh, I haven't seen you in a while, let's go grab a drink. We do it for the people, not the actual thing in front of us.”

Today, Sam Bail is the founder of Third Place Bar, a “booze-free bar pop-up” that puts on events around New York City. The project’s goal is to create environments that provide the social lubrication of the neighborhood bar for the city’s vibrant and growing “sober and sober-curious” cohort.

“A lot of people who come to Third Place and our events are people who drink,” she reports, “but are just really happy to have a night out without drinking.”

Data consistently shows that more of today’s young people fall into this sober-curious category than ever before. This isn’t just a pandemic thing, either. Between 2002 and 2018, the percentage of college-age Americans who abused alcohol fell by half, while the number who abstained completely rose from 20% to 28%. A 2021 Gallup poll found that 18–34 year olds drank 14% less than 35–52 year olds.

For restaurants, the upshot is not so much that alcohol sales are in danger of evaporating, though that product revenue could very well decrease over the long run. More realistically, restaurants now need to prepare for a new kind of diner. One who will intermix with drinking customers and expect options on the menu that cater to them.

Think of sober and sober-curious customers like Sam Bail as a new kind of vegetarian or vegan. Just as the rise of those dietary preferences didn’t spell the end of meat, it did require menus across the industry to start including options that made them feel welcome — and that kept the check size up.

Demanded by customers, appreciated by staff

About a mile to the west of Sam Bail’s old neighborhood, restaurateur Patricia Howard’s concepts Dame and Lord’s bracket a chunk of Greenwich Village that is home to places like Carbone, Jane, and Dante NYC. Step into one of Howard’s restaurants, and you’ll be handed a drink menu that includes a prominent NA beverage section.

The offering wasn’t, originally, intended to be permanent. “For Dry January at Lord’s, we added a ‘Teetotaling’ section on our cocktail menu and a NA Guinness to the beer list,” says Howard. “The drinks sold well and seemed to be popular even with people not participating in Dry January, so we decided to keep them on the menu after January.”

Patricia Howard (center) with the Dame team, April 2022. (Via Instagram)

Since then, a few “mocktails” have proven to be consistent sellers. The whiskey sour, made with non-alcoholic bourbon Lyre’s American Malt, and the Last Word, made with Pentire NA gin, Vera Aperitivø Herbal, simple syrup, & lime juice, are “beloved” by bartenders and guests alike.

Critically, the mocktails hold their weight economically. Although NA spirits are expensive — usually priced comparably with small batch spirits — the drinks sell for $12–15, which is 3–4x their cost of ingredients.

According to Howard, a near-cocktail price point helps the restaurant — and the conscientious diner — in two ways.

First, it accommodates every customer profitably. “Not only does an NA cocktail menu elevate the experience of our guests who might not want to drink alcohol that evening, it also makes more money than old school NA options like Coke or lemonade or tap water.”

Premium mocktails also help Howard herself, as someone who manages a staff of servers, enjoy a night without alcohol. “I enjoy going out to dinner often, but I don't always want to consume alcohol when I do. At the same time, I know how much staff morale can suffer on a night when multiple tables in a row say they aren’t drinking and check totals will be lower. So I’m usually conflicted between not wanting to drink and wanting to support my fellow restaurants and make the staff happy.

“Having exciting non-alcoholic options available is a welcome solution. I can go out to dinner without feeling pressured to order an alcoholic drink.”

Howard opened her second concept, Lord's, just one year after Dame. (Via Instagram)

Howard has turned into enough of an aficionado of NA beverages that she does the ordering for Dame and Lord’s based on preference alone. “Personally, I gravitate towards strength of flavor or taste rather than how well something mimics an alcoholic spirit,” she says. Howard has preferred drinks and her preferred vendor, but developing her restaurants’ NA list is largely a journey she wants to take herself. “I haven’t had many NA reps reach out to me yet. I prefer to do the research myself and contact our rep when I want to order something.”

Innovation in the industry

Not too long ago, it would have been rare for a fine dining connoisseur like Patricia Howard to describe any NA beverage as “exciting.” But the past few years have seen an explosion in the products available in the sector.

Will Ryan is a beverage industry veteran currently working with Avec, a ready-to-drink NA product. (Ready-to-drink products compete with NA spirits like Seedlip and Ghia — Howard’s favorite — which are sold like conventional bottled spirits and must be mixed into cocktails.) Ryan saw the rise and maturation of the craft beer movement up close and thinks a similar arc is in its opening stages here.

Avec's ready-to-drink NA beverages. (Via Instagram)

“The market is really interesting right now. There is a tremendous breadth of non-alcoholic drinks of all varieties and price points. We’re not yet at a point where there is an industry standard."

Ryan explains that despite already robust demand for NA spirits, the sector is debuting so many new drink options regularly that a maturation point is still far away. “With alcoholic beverages, we’re used to seeing specific products trend for a period of time: A few years ago it was orange wine. Hazy IPAs had a moment. In non-alc — especially with all the money pouring in from venture capital — it’s growing so much that there isn’t one product that’s defining the sector.”

One important reason for the growth of the NA product line is innovation in the production process: how the drinks get made. Companies on the cutting edge of non-alcoholic production are genuinely inventing new food science.

Dorothy Munholland is a co-founder of the non-alcoholic wine brand Studio Null. Her job entails more than just building a brand in a completely new category. It also requires her to continually reimagine the product’s production itself.

“There are a few different ways one could approach a non-alcoholic wine,” she explains. “Some brands are doing really interesting mixtures of juices and teas and other fermented ingredients to build up to a wine-like profile. Those never have alcohol in them to begin with. We've taken the alternate route, which is to start with fully fermented wine and oversee the dealcoholization, making some little adjustments after to ensure it's stable.”

Studio Null's Prickly Red tasting trials. (Via Instagram)

The creation of something as technically challenging as non-alcoholic wine is essential to the story the brand is able to tell the restaurant, and the restaurant is able to sell to the guests. “When you take the alcohol out, removing up to 16% of what the wine originally was, there is a fundamental change in the taste and the mouthfeel and the aromatics of the wine,” Munholland says. “So it's a delicate question whether you want to communicate, ‘This is a chardonnay, but it might not be the chardonnay you’re used to drinking.’”

Part of Studio Null’s solution has been to start with wine made from more esoteric grapes, like Portugieser and Silvaner. “Which I think is really exciting for these beverage directors, because it's fun for them to see something a little bit more esoteric and different.”

Will Ryan sees a lot of potential in the expanding horizons of this innovative product sector. “Non-alcoholic beverages are really in their R&D era,” Ryan says. “Every new method of production adds to the diversity of the space. All of it is helping to establish a range of non-alc products with varying complexities.” Each new type of NA beverage means that a restaurateur like Patricia Howard might come across something she finds delicious, or something she can pair well with a menu item.

“Our bartenders enjoy experimenting with the NA spirits,” Howard says, “and our servers suggest novel uses for our guests.” Experimentation, in other words, is currently the dominant theme across the entire NA space, from producer to restaurant to customer. For restaurants interested in unconventional ideas, being able to meet what Howard describes as “very strong demand” has never been more interesting.

The new vegetarians

Are premium non-alcoholic drinks a fad? On a scale from “vegetarianism” to “Atkins diet,” all signs point to the former.

NA beverages are gaining fans and investment dollars because sober and sober-curious customers are making enduring lifestyle choices. Restaurants and bars are meeting the demand by getting creative with the exciting and expanding world of NA beverage options. Producers, in turn, are trying out new ways of making the products. It’s a category in the midst of a Cambrian explosion, and that makes it unlikely to simply fade away and give back territory to the old days of near-beer and soft drinks.

“I like the idea of saying, ‘Look, you can have fun doing the exact same thing that you would be doing otherwise, just without the alcohol,’” says Sam Bail. “And that's okay.

“The idea that you have to drink to make a social event fun is, at this point… It’s 2023. Let's move on.”

Recommended

Marketing

See How Modern Diners Are Finding New Restaurants

May 17, 2023

When a diner sets foot into their new favorite restaurant this year, there’s a good chance they’ll have paid a virtual visit first.

Community

The Power of Restaurant Mentors: Industry Insights & Inspiring Stories

May 10, 2023

How real restaurateurs have grown their careers through community.

Community

Can Restaurants Save Meatless Meat?

February 7, 2023

Why meat alternative companies like Impossible and Beyond are here to stay — especially if a creative chef or two can score a hit.