Interview

How to Manage a Restaurant Budget

February 26, 2020

Tips from RASI on how to effectively manage your restaurant’s budget

Operating any business—let alone a restaurant—is an often difficult, yet rewarding pursuit. Besides the daily tasks of overseeing prep work for service, placing and accepting deliveries, and managing employees—as well as payroll—the most challenging aspect of it all, is doing so within a set budget. In an industry with razor-thin margins, this should always be top-of-mind.

Today, restaurant operators have greater access to services and technology to help them navigate financial decisions and processes. We talked with our partners over at RASI, the industry-leading restaurant accounting service, about how to manage a restaurant budget and stay within profitable margins. Their proprietary software is backed by a team of professionals with over 40 years of restaurant bookkeeping and accounting services under their belt.

Learn about 6 Restaurant Metrics and How Operators Measure Them.

What are the most important factors to include in a restaurant budget?

Factors that you want to identify are:

Properly forecasted sales

Realistic and attainable targeted cost goals

Reviewing past financial history

Operators who set specific and measurable goals for improvement – and create a budget to those goals – are far more likely to see better results.

Is it important to forecast sales?

Absolutely! Forecasting sales properly is key for having a budget that will be meaningful and reflect as close-to-actual of what your retained earnings and cash flow will be over a period of time.

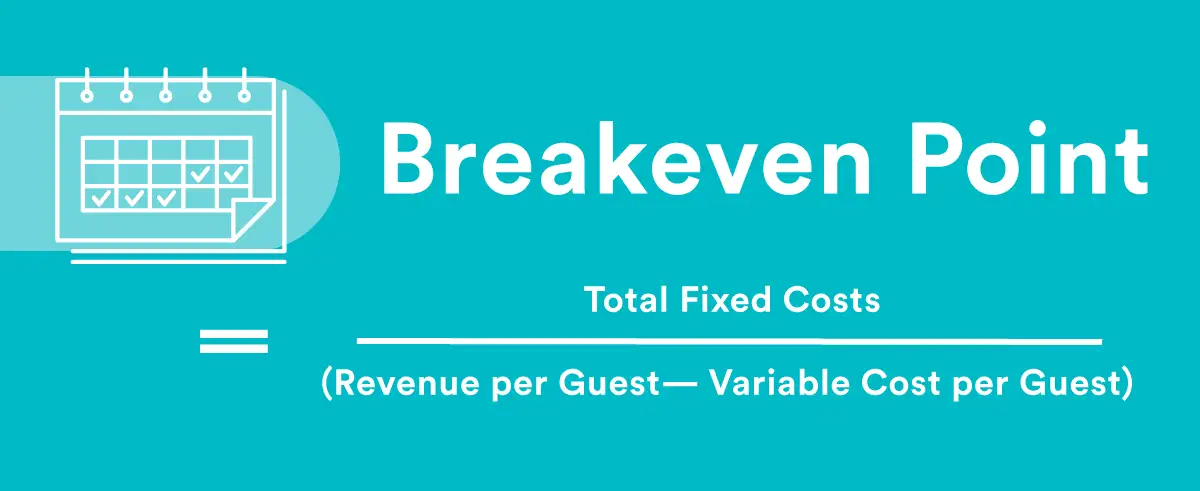

Can you explain the breakeven point? Is it different for fast-casual restaurants versus fine-dining concepts?

The breakeven point is the point at which total cost and total revenue are equal. Breakeven has no bearing on what type of concept you are. Understanding your breakeven point is extremely important for you to also understand what your cash flow will be and where you need to be at on top-line sales to be profitable.

Total Fixed Costs: These are items that are necessary for your business and must always be paid. They do not fluctuate by the number of guests or items sold. Examples of fixed costs are:

Rent, Insurance, and Taxes

Electricity and Water

Licensing and permits

Internet and phone services

Marketing costs

Revenue per Guest: If you add up total revenue for the month and divide it by the number of guests, you will get your average revenue per guest.

Variable Cost per Guest: Variable costs depend on the business volume. These are items that you will need more or less of, based on how busy your restaurant is. To get the variable cost per guest, divide your variable costs by the average number of guests per month. Examples of variable costs are:

Food, drink, and supplies costs

Credit card processing fees

Labor costs

Should growth plans be included in the budget? For example: setting money aside for a second location, etc.

You can anticipate your retained earnings by having a budget in place, but future growth plans will not be included in your individual store budget. If you have future expansion plans, then being able to understand what your retained earnings will be, will assist you in knowing what amount of cash flow you will be able to put away for your future growth plans.

What are some of the things restaurant operators can do to help maintain a healthy budget?

Create a Weekly Budget: It is important to break your budget down on a weekly basis. The purpose of the weekly budget is to anticipate, monitor and make adjustments on things that the management team has control over. The effectiveness of a weekly budget is driven by actions taken every day in the restaurant.

The most successful managers at controlling costs use the budget as a starting point for managing the costs they have the largest impact on. They forecast sales using a combination of the budget, recent sales trends, YOY sales trends, weather and sales-affecting events to project weekly sales. Using these forecasts, they can adjust ordering par levels and staffing levels each week.

What are things that operators should avoid that will put their budget in jeopardy?

Often, operators build a budget based on “desired” results, versus what is actually attainable. Over projecting the basis of your sales will give you a false outcome of bottom-line profit, cash flow and more.

For accuracy, operators should make sure that the fixed semi-variable costs on financial statements are budgeted as close to actual as possible.

What unique issues do restaurant owners face in 2020 when it comes to running a successful business financially?

Labor: While not unique to 2020, this will continue to be a factor year over year as the minimum wage continues to increase. This can be such a large percentage of your prime costs that understanding ideal labor cost for your establishment and managing it daily/weekly will be key to keeping it in line.

Capital: Unexpected costs will always crop up, so you must plan for it. You must expect that the actual cost may be higher than initially budgeted and allocated for. Always have a cushion, so that unexpected costs will not bankrupt the restaurant.

If you’re interested in an industry-leading accounting service please contact Dan Jacobs (djacobs@rsiaccounting.com) at RASI for a demo and be sure to mention BentoBox to receive preferred pricing.

Recommended

Operations

6 Key Restaurant Metrics to Track to Stay Profitable

July 18, 2019

These are the metrics you should be tracking regularly.

Interview

Q&A with Chef Chris Scott and Eugenie Woo of Butterfunk Kitchen

January 18, 2018

How appearing on Bravo’s Top Chef has impacted their restaurant, their website and more

Interview

Q&A with Shore Gregory of Row 34 and Island Creek Oyster Bar

September 6, 2016

The Boston based restaurateur’s thoughts on OpenTable, overcoming failure, and more